As an asset manager and investment adviser for 3 decades, there are a number of things that you become aware of over time. While in the industry we often assess returns in relation to various indices, most small shareholders experience a completely different reality when it comes to returns. In this sense, the last 2-3 years have been particularly challenging for many.

It is important to point out that there are several approaches and strategies to succeed in the stock market, but for the majority, investing in one or more funds is the primary starting point. Two of the most underrated investment rules that one should have with them are, in my opinion:

- the value of being diversified, which I will discuss more in a later post, and

- the value of avoiding errors / blunders / large price falls.

At this point, I will not say too much about index funds versus active (“ordinary”) funds, but only that the aforementioned investment rules can work both ways. While active funds are typically good at avoiding the worst mistakes or loss bombs, on average they are not as good at including the winners, often because the winners are typically somewhat dearer than the average price. For the ordinary private investor, it is often the inability to avoid the worst investments that has the greatest negative impact. The importance of diversification does not only apply across several companies or asset classes, but also to avoid concentration in popular and trendy segments.

Most people who choose their own investments will often base their choices on what friends and acquaintances say, what they have heard talk about and/or what they read in the newspapers. The biggest danger with this as a basis for analysis is that you invest in something that has already risen a lot in value, become popular, and is probably approaching “bobble” levels. FOMO (Fear of missing out) is a strong psychological factor for many of the investment choices one makes.

The latest example we have seen of this is the focus we saw a couple of years ago on the environmental, sustainability and so-called “green” investments. This period also coincided with a period where many startups and new listings fell into this category. Also, the newspapers were full of articles about start-up funds, climate funds, venture funds and individual investors who had earned thousands of percent in returns on some of these companies. What then often happens is that you start to feel inferior or bad as an investor if you are not involved in these investments. The result is that when these companies are listed, private investors pounce.

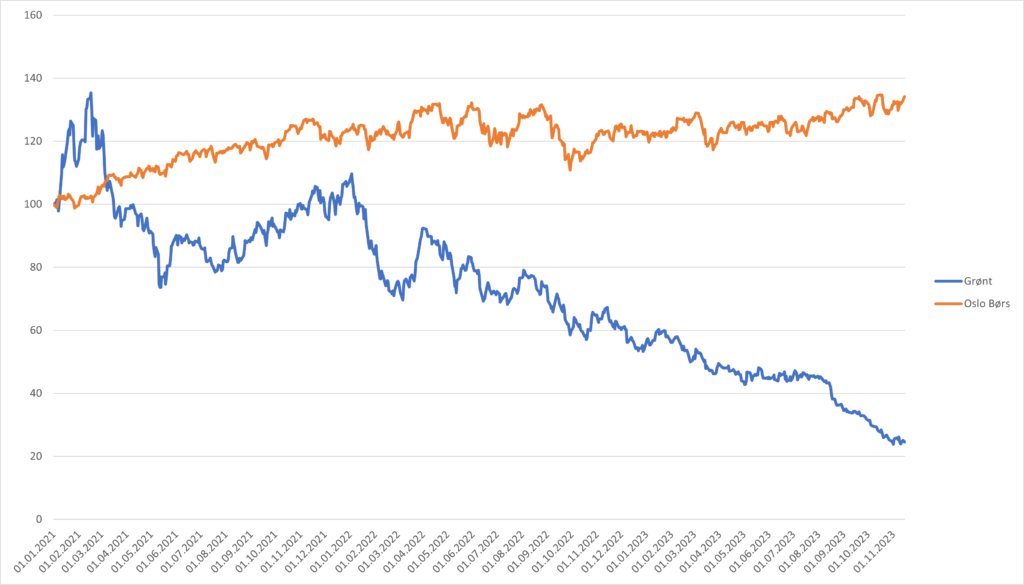

If we look at a random selection of some of the better-known names that fall within the aforementioned category, they have on average fallen by almost 80% in the last 3 years. In the same period, Oslo Børs has risen by 35%. An informal analysis of a democratically selected portfolio on one of the Norwegian stock exchange forums on Facebook shows that it is typically these shares that many small shareholders choose to include in their portfolios.

The graph shows the development of an index consisting of Aker horizons, Desert Control, Waste Plastic Upcycling, Huddly, Freyr, Quantafuel and Nordic Unmanned, vs Oslo Børs

Now it must be said that all investment in shares involves risk, and some additional risk must be tolerated if you want to seek a return in line with the market or better. But history shows that if this proportion becomes too large, the result can be disastrous.

So it is easy to think that the aforementioned selection of shares is peculiar and special, but unfortunately it is not. Corresponding indices from i.a. The USA shows approximately the same return for the same period. But it is even more important to emphasize that we have seen a similar phenomenon on many occasions throughout history. The most conspicuous is often the dot-com period, a period that had many of the same characteristics – with similar outcomes. The takeaway point must be to always have a sensible diversification, and preferably avoid as much as possible of what looks like, smells like and feels like bubbles.

The more something is hyped up in stock forums on the internet or around the coffee table at work, the more skeptical one should be. But to go back to the starting point, there are many ways to make money in the stock market. But unless you want to have this as a profession, you should probably distinguish between “Pension fund” and “Sandbox”. In the Sandbox, you can continue with investments that you think are fun and exciting, but this part should not be larger than the amount of capital you can afford to lose. The pension fund should be the part of the capital where long-term risk-adjusted returns are paramount. Then it is probably appropriate to round off with a quote from Warren Buffet, one of the best investors of all time; “If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.”

Even Krohn-Pettersen

Chief Investment Officer

Stavanger Asset Management AS